Did Christmas sneak up on you last year? In this post I’m going to share with you a new Christmas budget tracker I created to help me plan for Christmas so I never feel like it sneaks up on me ever again!

No matter how many months we have, it always seems hard to save for Christmas.

How much do we need? Should we pre-save for it monthly? What should we include in the Christmas budget?

What is the purpose of this tracker?

I created this to help me come to terms with how much I was spending for Christmas. I thought a little decoration purchase here, a couple gifts there, how much could it really be, right?! WRONG!

All those little purchases add up.

Read: How I Use My Expense Tracker

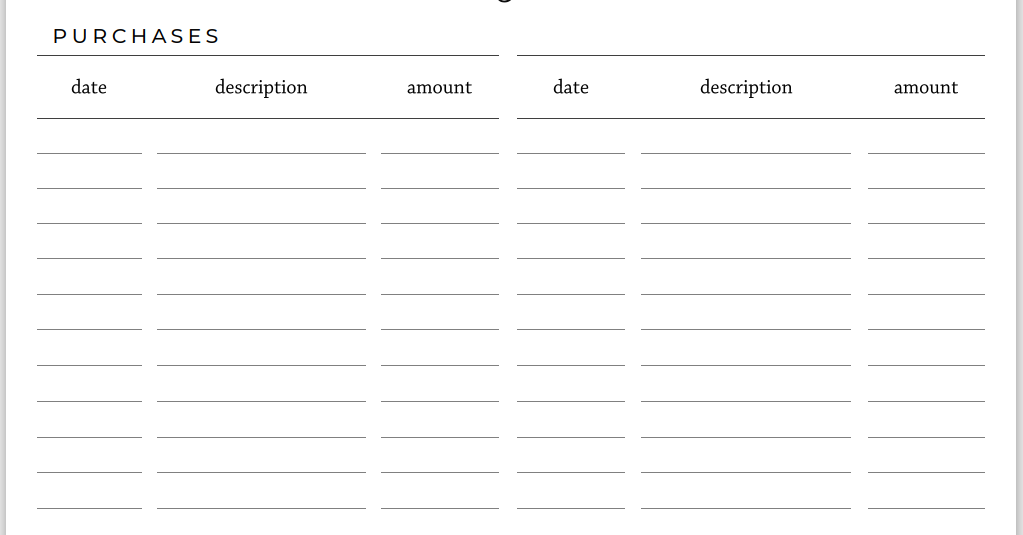

Track all your purchases

The first thing we’re going to do is to write down everything you spent on this last Christmas.

We’re including expenses like:

- Presents

- Decorations

- Clothing

- Pictures

- Cards

- Meals

- Travel expenses

Anything you can think of, that you and your family spent for “Christmas”.

Don’t forget about subtracting any returns that you might have.

Once we have our total we can move on to the next step.

Read: Weekly Budget Check In Tracker

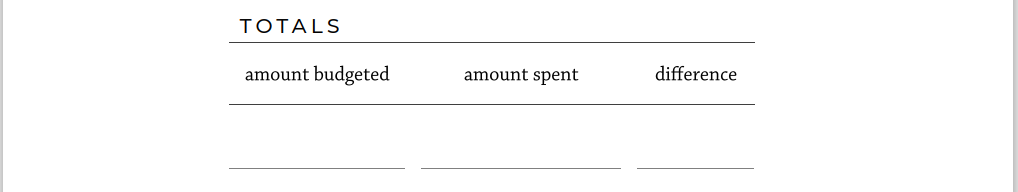

Find your totals

You will take your total amount spent and subtract it from the total amount you budgeted and come up with a total.

Are you negative or positive? DId you spend more than you thought? Or were you under budget?

Take a minute and actually think about how you spent your money. Were you careless? Or were you too tight? Or did you spend just the right amount? DId you have to go into debt? Did you buy unnecessary things? Or feel like you could have gotten more?

This process is to identify your ideal Christmas holiday with your family. That way we know how to move forward and take the lessons learned and make this holiday season the best yet.

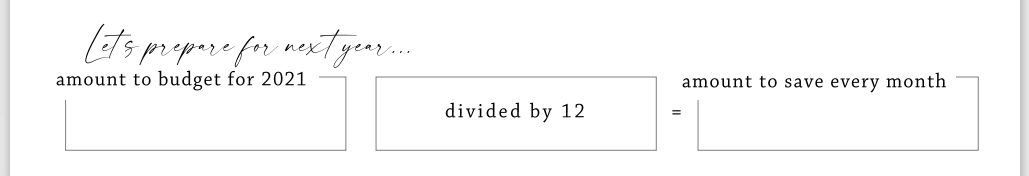

Now let’s prepare for next Christmas

Put in how much you want to allocate to christmas this year and divide it by 12, to get the amount you need to save every month to get to your total by the end of the year.

There! Now you have the amount you need to set aside every month to have your goal number by December.

This is also called a sinking fund. You can either keep this in cash at home (in a safe preferably) or in a separate savings account to keep it separate from your main checking account.

Another great thing about saving this way is that if you find any great deals throughout the year, you can access this fund and have money to spend for gifts without any worry.

Did I also mention that this printable is free?!

I’ve added it to my free resource library… all you have to do is sign up below and I’ll send it straight to your email!

Access the free resource library!

Enter your name and email and I will send you all the info you need to login!

Also, every Saturday, I send you a short helpful email with a Saturday Surprise!